The ARK 3D Printing ETF (CBOE: PRNT) was a quiet star among thematic exchange traded funds in 2020, despite gaining more than 40%. The lone 3D printing ETF can deliver again for investors in the new year.

.

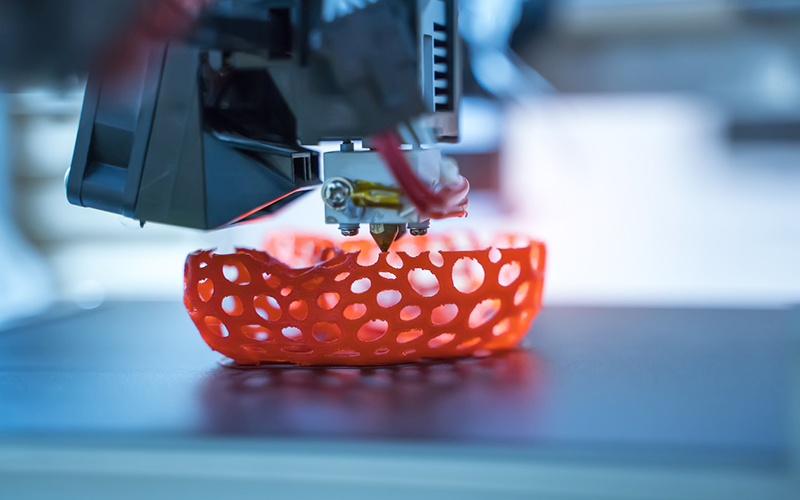

Passively managed PRNT offers leverage to its namesake as its benchmark “is composed of equity securities and depositary receipts of exchange-listed companies from the U.S., non-U.S. developed markets and Taiwan that are engaged in 3D printing-related businesses within the following business lines: (i) 3D printing hardware, (ii) computer-aided design (“CAD”) and 3D printing simulation software, (iii) 3D printing centers, (iv) scanning and measurement, and (v) 3D printing materials,” according to Ark Investment Management.

.

3D printing, one of the original disruptive technologies, intersects with a variety of industries and its materials applications that could bode well for PRNT’s long-term trajectory. The coronavirus affected the 3D printing industry last year, but it’s ready to shake out of that funk. “Progress and innovation continued, however, and new technologies and pent-up demand will help accelerate the market in 2021 and beyond,” reports TCT Magazine . Where Do 3D Printing ETFs Like PRNT Go From Here? PRNT debuted nearly three years ago as the first US-listed […]

Case Study: How PepsiCo achieved 96% cost savings on tooling with 3D Printing Technology

Above: PepsiCo food, snack, and beverage product line-up/Source: PepsiCo PepsiCo turned to tooling with 3D printing...

0 Comments