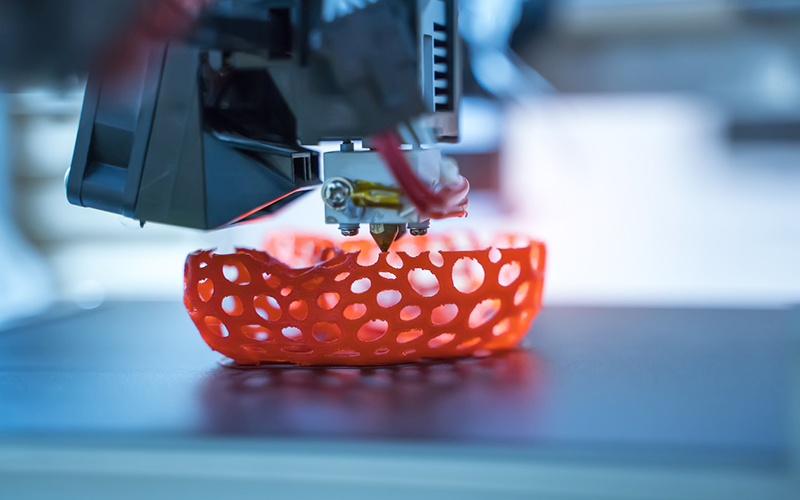

The International Tax Review reports that a tax ruling issued by the Brazilian Federal Revenue Service on whether 3D printing should be classified as a manufacturing process for a business could mean retailers are liable for excise taxes.

These are indirect taxes on the sale of a particular good or service such as fuel, tobacco and alcohol. Indirect means the tax is not directly paid by an individual consumer — instead, the Internal Revenue Service (IRS) levies the tax on the producer or merchant, who passes it onto the consumer by including it in the product’s price.

The growth of the digital economy is the result of transformative processes brought about by information and communication technology (ICT) and is changing business models. This is very important from a tax perspective. and can have implications all over the world. In fact, Because of this, the OECD issued BEPS (Base Erosion […]

Click here to view original web page at www.3dprintingmedia.network

0 Comments