The ARK 3D Printing ETF (CBOE: PRNT) was a quiet star among thematic exchange traded funds in 2020, despite gaining more than 40%.

.

The lone 3D printing ETF can deliver again for investors in the new year. Passively managed PRNT offers leverage to its namesake as its benchmark “is composed of equity securities and depositary receipts of exchange-listed companies from the U.S., non-U.S. developed markets and Taiwan that are engaged in 3D printing-related businesses within the following business lines: (i) 3D printing hardware, (ii) computer-aided design (“CAD”) and 3D printing simulation software, (iii) 3D printing centers, (iv) scanning and measurement, and (v) 3D printing materials,” according to Ark Investment Management . 3D printing, one of the original disruptive technologies, intersects with a variety of industries and its materials applications that could bode well for PRNT’s long-term trajectory. The coronavirus affected the 3D printing industry last year, but it’s ready to shake out of that funk. “Progress and innovation continued, however, and new technologies and pent-up demand will help accelerate the market in 2021 and beyond,” reports TCT Magazine . Where Do 3D Printing ETFs Like PRNT Go From Here? PRNT debuted nearly three years ago as the first US-listed […]

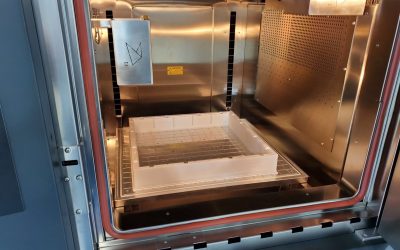

Case Study: How PepsiCo achieved 96% cost savings on tooling with 3D Printing Technology

Above: PepsiCo food, snack, and beverage product line-up/Source: PepsiCo PepsiCo turned to tooling with 3D printing...

0 Comments