One of the first disruptive technologies to burst onto the scene a few years ago was 3D printing. These days, it feels like the concept has been forgotten, but risk-tolerant investors ought to consider revisiting the theme with the 3D Printing ETF (CBOE: PRNT).

.

PRNT debuted nearly three years ago as the first US-listed ETF dedicated to the 3D printing theme. The fund is one of two passively managed products from New York-based Ark Investment Management.

.

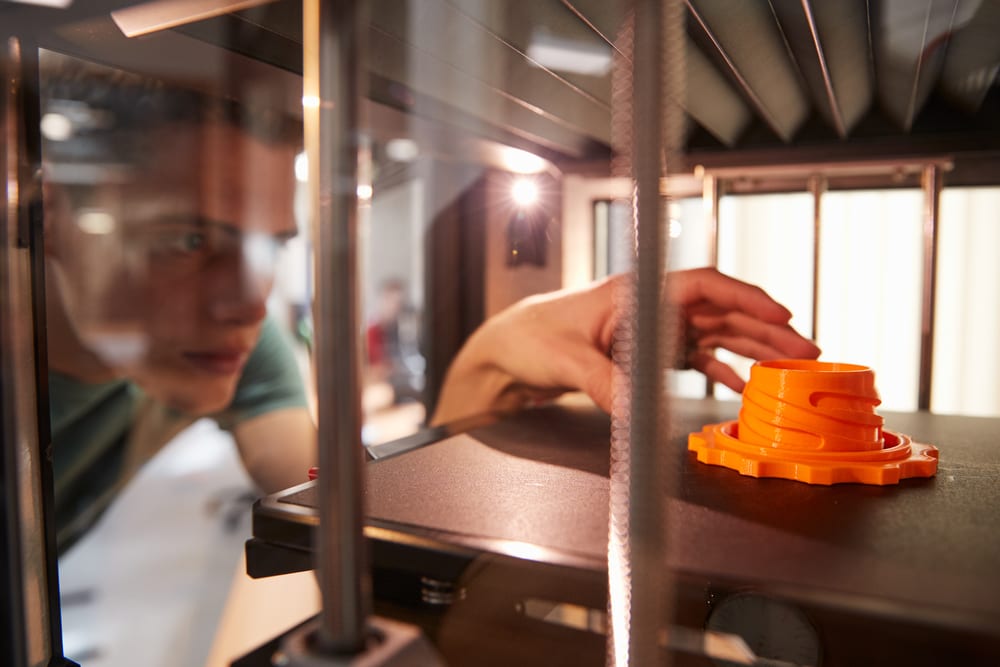

ARK believes 3D printing will revolutionize manufacturing by collapsing the time between design and production, reducing costs, and enabling greater design complexity, accuracy and customization than traditional manufacturing. Important to investors considering PRNT is that data suggest the 3D printing space isn’t just viable over the long, it’s poised to grow exponentially. “ARK believes 3D printing will revolutionize manufacturing, growing from $10 billion in 2018 to $97 billion in 2024 at […]

Case Study: How PepsiCo achieved 96% cost savings on tooling with 3D Printing Technology

Above: PepsiCo food, snack, and beverage product line-up/Source: PepsiCo PepsiCo turned to tooling with 3D printing...

0 Comments