HP Inc. on Sunday said its board unanimously rejected the recent takeover proposal it received earlier this month from Xerox Holdings, asserting in a letter to Xerox CEO John Visentin that the offer “significantly undervalues HP and isn’t in the best interest of HP shareholders.”

.

Xerox (ticker: XRX) had offered to buy HP (HPQ) for $22 a share , including $17 in cash and the remainder in Xerox shares. Xerox has a market value of $8.4 billion, while HP has a current market capitalization of just under $30 billion.

.

Xerox would need to take on considerable debt to complete the contemplated transaction, a fact that HP points out in its letter. “In reaching this determination, the Board also considered the highly conditional and uncertain nature of the proposal, including the potential impact of outsized debt levels on the combined company’s stock,” HP said […]

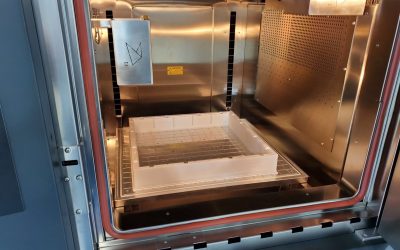

Case Study: How PepsiCo achieved 96% cost savings on tooling with 3D Printing Technology

Above: PepsiCo food, snack, and beverage product line-up/Source: PepsiCo PepsiCo turned to tooling with 3D printing...

0 Comments