The ARK 3D Printing ETF is higher by 24% year-to-date and has more than doubled in value over the past year, confirming that 3D printing stocks are roaring back to life.

However, some investors still remember the 2013 bust in 3D printing stocks, prompting thoughts about whether or not this time will be different. Back then, 3D printing equities were seen as one of the original disruptive technologies – a trait that holds true today. But hype permeated the market and the related stocks fell almost as rapidly as they surged. Some investors are wagering that the coronavirus pandemic will lift PRNT and its components again this year.

.

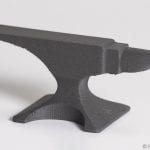

“Fans are betting that the pandemic has forced companies to reconsider how they manufacture goods longer term, with some looking more toward onshore production to prevent supply issues and shortages,” reports Laura Forman for the Wall Street Journal . PRNT is the first U.S.-listed ETF dedicated to the 3D printing theme . The fund is one of two passively managed products from New York-based Ark Investment Management . ARK believes 3D printing will revolutionize manufacturing by collapsing the time between design and production, reducing costs, and enabling greater design complexity, accuracy, and customization than traditional manufacturing. PRNT’s roster “is composed of equity securities and depositary receipts of exchange-listed companies from the U.S., non-U.S. developed markets and Taiwan that are engaged in 3D […]

Case Study: How PepsiCo achieved 96% cost savings on tooling with 3D Printing Technology

Above: PepsiCo food, snack, and beverage product line-up/Source: PepsiCo PepsiCo turned to tooling with 3D printing...

0 Comments